The Czech labour market will grow slightly towards the end of this year

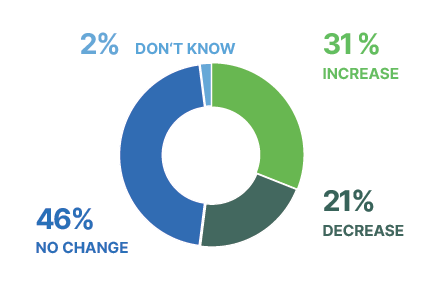

Czech organizations anticipate modest but positive hiring intentions in the upcoming quarter with a Net Employment Outlook (NEO) of 11 percentage points. The outlook has strengthened by 3 points compared to last quarter but remains unchanged from Q4 2023. The Czech Republic ranks fifth from last globally, 14 points below the global average.

Czech employers report improving employment expectations, even as the country’s economy is expected to see modest recovery in 2024. Recovery is seen in the inflation rate, which has decreased significantly, stabilizing at 2.0% in June 2024. Although the unemployment rate has risen slightly, it remains relatively low compared to other EU countries, with gradual improvements anticipated as economic activity picks up. However, the labor market faces challenges like labor shortages and an aging workforce, which could constrain growth in the long term.

“The labour market will continue to grow steadily in the last quarter of the year. Although the labour offices recorded an increase in unemployment during the holidays, this is an annual phenomenon caused by the arrival of graduates. September and October is the peak season in the world of work, as companies are hiring the most. Information technology, finance, and transportation and warehousing sectors report the highest levels of optimism for the end of the year. We observe the most nervousness in communication services and pessimism continues for more than a year in the public sector,” said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

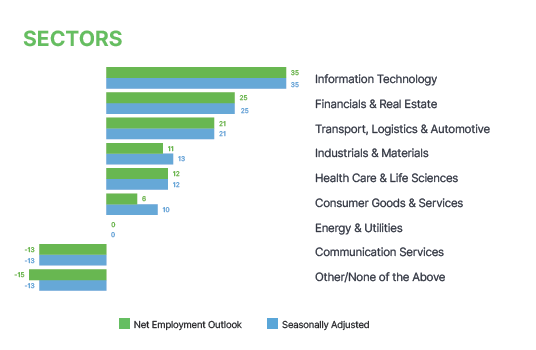

Industry sector comparisons

Employers in 6 of 9 sectors expect to increase staffing levels in Q4 2024, while 2 sectors predict a decrease and 1 sector expects no change. Compared to last quarter, employment outlooks have weakened in 5 sectors and strengthened in 4. Since this time last year, outlooks have strengthened in 5 sectors, weakened in 3, and remained unchanged in 1 sector.

The most competitive sector in the Czech Republic is Information Technology, with a NEO of 35, increasing by 20 points since last quarter and 5 points since last year. This quarter marks the highest NEO recorded in the Czech Information Technology sector since tracking began in Q1 2022.

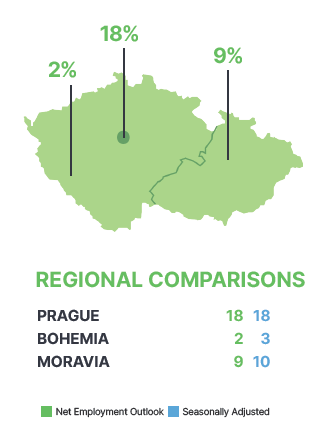

Regional comparisons

Employers in all 3 regions of the Czech Republic expect to increase staffing levels in Q4 2024. Since last quarter, staffing environments have strengthened in 2 regions and weakened in 1 region. Compared to last year, job markets have strengthened in 1 region, weakened in 1, and remained unchanged in 1 region.

The most competitive region in the Czech Republic is Prague, with a NEO of 18, rising by 1 point since last quarter and 8 points since last year. Since last quarter, the greatest growth in expectations was reported in Moravia, with an increase of 12 percentage points. The outlook in the region now reaches 10 points.

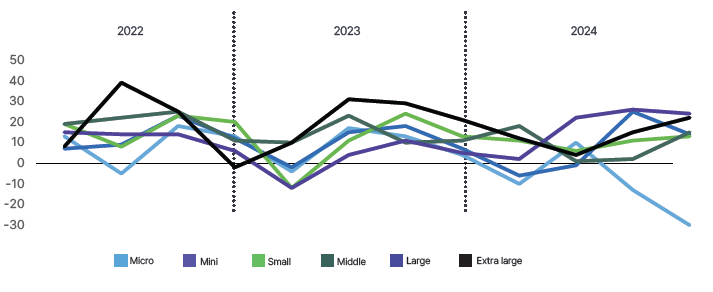

Organisation size comparisons

Employers in 5 of 6 organization sizes in the Czech Republic expect to increase staffing levels in Q4 2024, while 1 organization size predicts a decrease. Since last quarter, employment outlooks have strengthened in 3 sizes and weakened in 3. Compared to last year, outlooks have strengthened in 4 sizes, weakened in 1, and remained unchanged in 1 size.

Very large organizations with 1000-4999 employees are the most optimistic out of the Czech organizations, reporting a NEO of 24, although expectations decreased by 2 points since last quarter. However, the outlook in these organizations has risen by 19 points since last year.

Global overview

The employment outlook for the fourth quarter of 2024 indicates a labor market that is slowly but steadily improving, though it remains at a tipping point where it could either move towards recovery or further slowdown. While steady economic growth and easing of monetary policies in several countries have increased employer confidence, they remain cautious about accelerating hiring. The Q4 2024 ManpowerGroup Employment Outlook Survey (MEOS), which surveyed 40,340 employers across 42 countries and territories, captures this mix of uncertainty and cautious optimism among employers.

The MEOS survey highlights a gradual improvement in the global employment outlook, with the seasonally adjusted Net Employment Outlook (NEO) rising to 25. This marks a 3-point increase from last quarter, though the outlook remains 5 points below the levels recorded in Q4 2023. This suggests that while employers are slightly accelerating their hiring compared to last quarter, they have not yet returned to the hiring pace seen this time last year.

The strongest growth in employment outlooks is observed in the Information Technology sector, which has rebounded from last quarter’s decline amid concerns that tech company shares were overvalued due to the AI boom. With no slowdown seen in IT investment, confidence to hire has improved again. The outlook for this sector now stands at 35, representing a 6-point increase from the previous quarter. A similar recovery is seen in the Communication Services sector, which rose by 5 points to reach 16. This improvement occurs alongside a surge in digital advertising during the Paris Olympics and strong earnings reports from companies like Spotify and Netflix.

In contrast, the employment outlook in the Energy & Utilities sector remains subdued following new sustainability-focused regulations, changing sustainability targets, and significant fluctuations in oil prices. Tensions in the Middle East and conflict in Eastern Europe are still affecting this sector. In this context, the sector’s outlook falls to 8, representing a 1-point drop from last quarter.

The employment outlook for the upcoming quarter reveals a labor market that is now improving, but still at a crossroads between recovery and potential slowdown. Regional variations are evident, but with most countries presenting a mix of steady progress and caution. Overall, employers express cautious optimism, reflecting an acceptance of the delicate balance of global economic conditions.

More information available on www.manpowergroup.cz