Slight strengthening of the Czech labor market

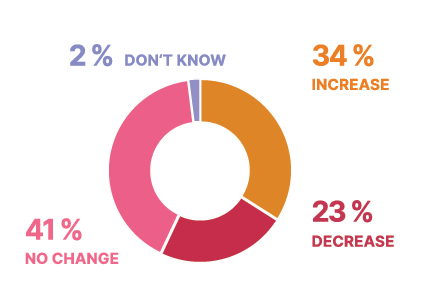

Czech organizations anticipate a modest hiring market during the next quarter with a Net Employment Outlook (NEO) of 8 percentage points. Since the previous quarter, employers anticipate the NEO to strengthen by 3 percentage points but worsen by 8 points compared to the third quarter of last year. The Czech Republic ranks seventh to last globally for its employment expectations, 14 points below the global average.

The Czech central bank continues to lower interest rates amid stabilizing inflation, fostering economic recovery. Rebounding consumer confidence is also giving organizations confidence about an improving economy. As the country’s labor market conditions are still tight (despite some easing recently), Czech employers expect to increase hiring from last quarter.

“We are seeing a slight recovery in the labour market, thanks to both seasonal work and employers’ milder concerns about the economy, who are opening more permanent jobs than in Q1. We see a positive outlook in 7 of the 9 sectors of the economy, with the most positive outlook in the health care, communications, trade and services, and financial sectors. Hiring is also prevalent in industry and logistics. The only exceptions are public services, government and the non-profit sector,” said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

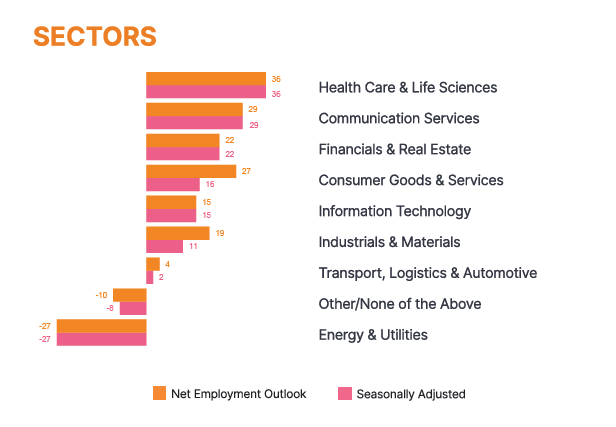

Industry sector comparisons

Czech hiring managers in 7 of 9 sectors anticipate increasing staffing levels in the next quarter, while the NEO in 2 sectors shows a decrease. Compared to last quarter, job markets have strengthened in 6 of 9 sectors and weakened in 3 sectors. On the other hand, compared to last year, staffing environments have weakened in 4 of 9 sectors, strengthened in 3, while seen no change in 2 sectors.

The Czech Republic’s most competitive sector is Health Care & Life Sciences with an employment outlook of 36, increasing by 12 percentage points since the previous quarter and 22 percentage points since a year ago. This quarter is the highest NEO recorded in Health Care & Life Sciences since we started tracking in Q1 2022.

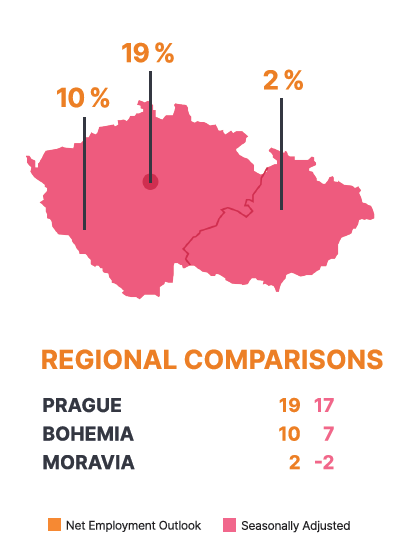

Regional comparisons

Czech organizations in 2 of 3 regions anticipate increasing staffing levels in the upcoming quarter, while 1 region forecasts a decrease. Compared to last quarter, hiring climates have strengthened in 2 of 3 regions and weakened in 1 region. However, compared to this quarter last year, hiring markets have weakened in all 3 regions.

The most competitive region in the Czech Republic is the Prague region with a NEO of 17, rising by 9 points since Q2 2024, but falling by 3 points since Q3 2023.

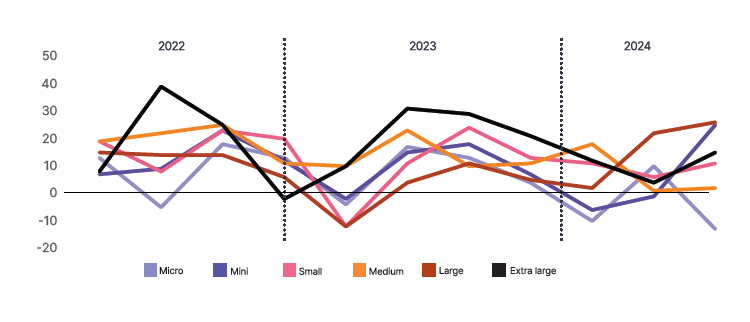

Organisation size comparisons

Czech employers in 5 of 6 organization sizes anticipate increasing staffing levels from June to September 2024, while 1 organization size is predicting a decrease. Since last quarter, job markets have strengthened in 4 of 6 organization sizes and weakened in 2 organization sizes. The opposite is the case when compared to last year, where hiring paces have weakened in 4 of 6 organization sizes and strengthened in 2 organization sizes.

Czech employers in very large organizations with 1000-4999 employees are the most optimistic with a NEO of 26, rising by 4 points since Q2 2024 and 15 points since this time last year. In fact, this quarter is the highest NEO recorded in the Czech Republic’s very large organizations since we started tracking in Q1 2022.

Global overview

The employment outlook for the third quarter of 2024 reveals a slowdown in large economies and sectors. This deceleration is more pronounced in countries still grappling with high inflation, while growing labor costs and reduced demand for knowledge workers are hitting sectors like Information Technology. Furthermore, geopolitical tensions in Ukraine and the Middle East continue to exert cost and supply chain pressures on the global economy. The Q3 2024 ManpowerGroup Employment Outlook Survey (MEOS), which gathered insights from 40,374 employers across 42 countries and territories, reflects this ongoing uncertainty and its impact on hiring intentions.

The MEOS survey highlights stability in the global employment outlook, with the seasonally adjusted Net Employment Outlook (NEO) remaining unchanged from last quarter at 22 points. The demand for talent remains at the same level as last quarter, but the NEO has yet to pick up to the levels seen this time last year (28).

Decreasing employment expectations are seen in previously strong sectors like Information Technology (IT). Although IT still reports the strongest hiring intentions (29) out of the sectors, moderate drops are expected from last quarter (-5) and last year ( 10). A similar trend can also be seen in the Communication Services sector (11), with corresponding falls from last quarter (-5) and last year (-11). This comes at a time when demand for skilled knowledge workers is falling, with the hiring rate for these workers slowing down considerably compared to factory and frontline workers. At the same time, there is news of fewer knowledge workers quitting, leaving fewer vacancies to be filled. Meanwhile, high inflation and spiking labor costs threaten organizations in the service sector.

In contrast, expectations in the Transport, Logistics & Automotive sector (21) bounce back from the decline last quarter (+5) following fewer disruptions in global supply chains, while global tensions put more emphasis on local and regional supply chains. This rise is tempered by uncertainty in the Energy & Utilities sector (9), where employment expectations fall sharply by 9 points from last quarter.

Major economies like the USA and China also report cooling employment expectations. In the USA (30) employment expectations drop by 4 points from last quarter, falling for the fourth consecutive quarter. Indeed, the American labor market continues to cool as inflation picks back up and interest rates remain high. Similarly, China’s (28) hiring pace slows for another quarter (-4) while India (30) sees its first major drop (-6) since this time last year. This trend is reflected in the overall outlooks for North America (27) and Asia Pacific (23), both of which report a drop of 4 points from last quarter.

In comparison, the Europe, Middle East and Africa region (EMEA; 18, +2) and South and Central Americas (22, +3) report improving employment expectations from last quarter. As the eurozone has officially bounced out of its technical recession and inflation is easing in key economies like Germany (23), France (24), and Italy (16), employers are cautiously optimistic. Indeed, these countries are bouncing back from their previously reported dips in employment intentions. Similarly, South and Central Americas report some optimism: Brazil’s (27, +9) inflation eases further and Mexico’s (32, +5) central bank cuts interest rates.

In sum, major economies and sectors feel the pinch in the upcoming quarter as inflation and high labor costs are biting. However, some signs of recovery are seen in regions previously hard hit by recession and international conflict. Taken together, employers remain in a wait-and-see mode as the global economy wavers.

The next ManpowerGroup Employment Outlook Survey featuring the forecast for the 4Q 2024 period will be published on 10th September 2024.

More information available on www.manpowergroup.cz