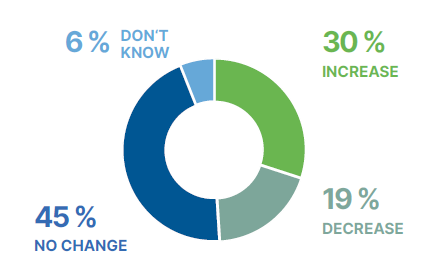

Demand for Employees Expected to Grow at the Start of Next Year

Hiring optimism among companies has remained stable for the third consecutive quarter. It also remains relatively high across the rest of Europe, including Germany, though it has slowed slightly.

“Unemployment continues to fall and the country’s economic growth forecasts look promising. Uncertainty reigns over the automotive sector, which is heavily affected by the transition to electric mobility. However, our data shows that the first quarter of 2025 will be marked by further growth in corporate demand for new hires across the economy. Optimism has been strongest for 3 years in the financial sector, real estate and IT. Currently, the energy sector has strengthened significantly, and industries, including automotive and logistics are poised for further hiring. We are one of the few countries in the world to report an increase in optimism both compared to last quarter and year-on-year,” comments the labour market situation Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

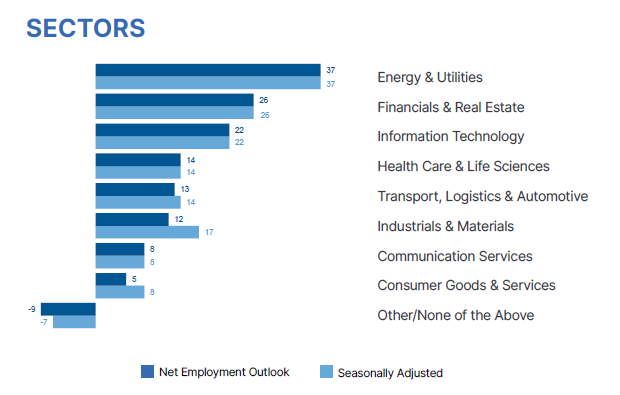

Industry sector comparisons

Czech organizations in 8 of 9 sectors expect increasing staffing levels in the first quarter of 2025, while employers in 1 sector expect a decrease. Compared to last quarter and this time last year, job markets have strengthened in 6 sectors and weakened in 3.

The most competitive sector in the Czech Republic is Energy & Utilities, with a NEO of 37. This sector reports the greatest growth in expectations out of the Czech sectors, up by 37 points from last quarter and 26 points from this time last year. In fact, this quarter is the highest NEO recorded in the Czech Energy & Utilities sector since we started tracking in Q1 2023. Globally, the Czech Republic ranks sixth for its expectations in the Energy & Utilities sector, above its average outlook by 27 points.

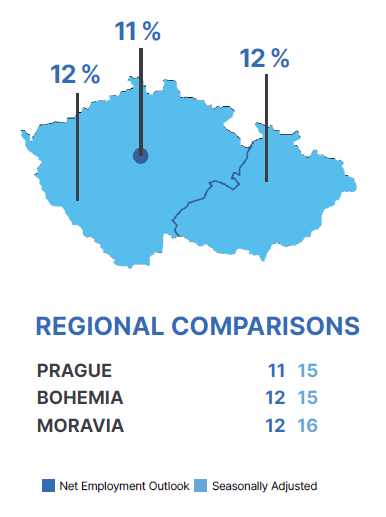

Regional comparisons

Czech organizations in all 3 regions anticipate an increase in staffing levels in the next quarter. Since last quarter, employment outlooks have strengthened in 2 regions and weakened in 1. Since this time last year, hiring intentions have strengthened in all 3 regions.

The most competitive region in the Czech Republic is the Moravia region, with an NEO of 16, rising by 6 points since last quarter and 9 points since this quarter last year. Meanwhile, the region reporting the greatest growth in expectations since last quarter is Bohemia, with a rise of 12 points.

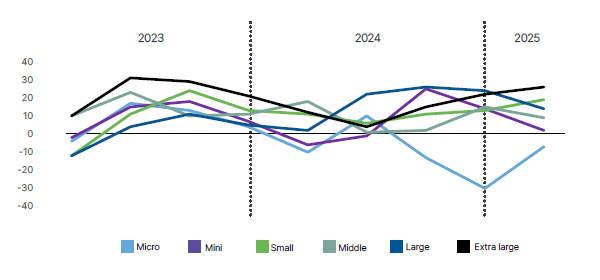

Organisation size comparisons

Czech employers in 5 of 6 organization sizes anticipate an increase in staffing levels in the upcoming quarter, while just 1 predicts a decrease. Since last quarter, hiring intentions have strengthened in 3 organization sizes and weakened in the remaining 3. Since this time last year, hiring intentions have strengthened in 4 sizes and weakened in 2.

Czech employers in large enterprises with 5,000+ employees are the most optimistic, with a NEO of 26, rising by 4 points since last quarter and 14 points since this quarter last year. However, the greatest improvement is reported in micro-organizations of less than 10 employees, where the employment outlook recovers by 21 points from last quarter. The NEO in these micro-organizations is now at -9.

Global overview

The Q1 2025 ManpowerGroup Employment Outlook Survey (MEOS) surveyed 40,413 employers across 42 countries and territories. The data collection took place in the context of recovering but underwhelming global economic growth, as described by the International Monetary Fund (IMF). While economic forecasts were upgraded for the United States and Asia Pacific region, these gains are offset by downgrades in Europe and emerging markets. These trends are reflected in our results; despite a resilient global employment outlook, several countries, particularly in Europe, report cooling employment expectations. Uncertainty for global trade and defense was also heightened by the US presidential elections, undecided at the time of the research (October 1-31, 2024).

The global employment outlook holds steady, with the seasonally adjusted Net Employment Outlook (NEO) remaining at 25, unchanged from the previous quarter and reflecting only a 1-point decline from the same period last year. These figures indicate that employers will maintain stable hiring levels in the upcoming quarter, mirroring the broader global economic trend of stability paired with slow growth.

Overall, the global employment outlook continues to signal caution and uncertainty. As businesses navigate this evolving landscape, they are not accelerating their hiring.

More information available on www.manpowergroup.cz