CAUTIOUS SLOWDOWN IN THE CZECH LABOUR MARKET

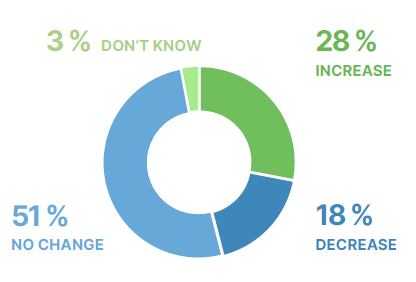

Hiring managers anticipate a modest staffing climate in the Czech Republic during the upcoming quarter with a Net Employment Outlook (NEO) of 8 percentage points. Although Czech organizations expect the NEO to worsen by 3 percentage points since last quarter, the NEO still strengthens by 7 points since this time last year. However, the Czech Republic ranks second to last globally for its employment expectations, 18 points below the global average.

In the Czech Republic, the combination of an economic slowdown and high inflation is negatively impacting employer confidence in consumer-driven sectors. Additionally, the continuous shortage of skilled workers is expected to lead to wage hikes in specialized sectors.

„In the first quarter of 2024, employers will mostly be hiring. However, optimism has fallen slightly again. Although firms’ hiring plans are significantly higher than this time a year ago, when the energy crisis was at its peak, the number of firms planning to lay off has risen compared to the previous quarter. Optimism is highest in the Finance, Insurance and Real Estate sector and then in IT. The most pessimism is observed in the public sector and in industry. In the Czech Republic, a combination of a slowing economy and high inflation is negatively affecting employer confidence, especially in consumer-oriented sectors,” said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

Industry sector comparisons

Czech organizations in 8 of 9 sectors expect an increase in staffing levels in the next quarter, while the NEO in 1 sector shows no change. Compared to last quarter, staffing climates have weakened in 5 of 9 sectors and strengthened in 4 sectors. Looking back to the first quarter of 2023, hiring environments have strengthened in 6 of 9 sectors, and weakened in 3 sectors.

The most competitive sector in the Czech Republic is Financials & Real Estate with a NEO of 33, increasing by 7 percentage points since Q4 2023, and 43 percentage points since this time last year.

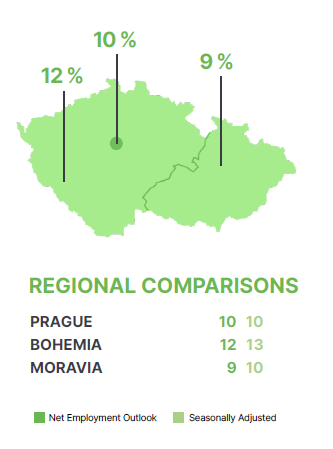

Regional comparisons

Czech organizations in all 3 regions anticipate an increase in staffing levels in the first quarter of 2024. Since the previous quarter, hiring paces have weakened in 2 of 3 regions and strengthened in 1 region. The opposite is true compared to Q1 2023, as staffing climates have strengthened in 2 of 3 regions and weakened in 1 region.

The most competitive region in the Czech Republic is the Prague region with a NEO of 12, rising by 2 percentage points since Q4 2023, and 11 percentage points since this time last year. This region is the only one to report a growth in expectations quarter on quarter.

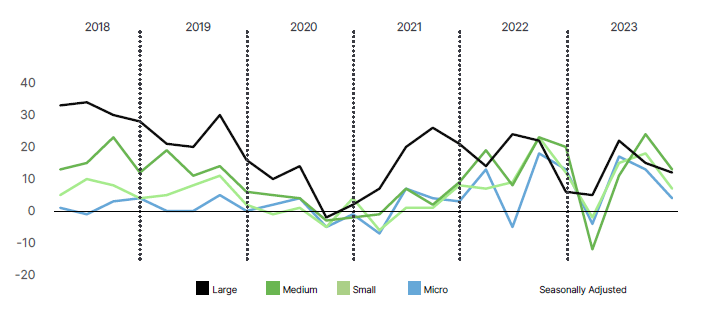

Organization Size Comparisons

Czech employers in 5 of 6 organization sizes anticipate an increase in staffing levels in the first quarter of 2024, while 1 size is expecting a decrease. Since the previous quarter, hiring climates have weakened in 4 of 6 organization sizes and strengthened in 2 sizes. Looking back to Q1 2023, hiring climates have strengthened in 4 of 6 organization sizes, weakened in 1, and seen no change in 1 organization size.

Czech employers in large organizations with 250—999 employees are the most optimistic with a NEO of 21, rising by 9 points since the previous quarter and 8 points since the first quarter of 2023. These organizations report the greatest growth in expectations since last quarter.

Global Overview

In the first quarter of 2024, organizations’ concerns over the global economy heighten as weak growth is expected for the upcoming year. It appears that the economic slowdown is finally starting to cool down the labor market. Meanwhile, the impact of geopolitical tensions, including the Israel-Hamas and Ukraine-Russia conflicts further increase uncertainty among organizations. As a result, employers in most countries are slowing down hiring in the upcoming quarter, which is the key finding of the Q1 2024 ManpowerGroup Employment Outlook survey of 40,077 employers across 41 countries/territories.

In Q1 2024, global hiring intentions fell after rising for three consecutive quarters, as employers anticipate slowing the pace of hiring from last quarter. This is reflected in the seasonally adjusted Net Employment Outlook (NEO) dropping from 30 to 26. Despite this drop, employment intentions are above those seen a year ago, when the NEO was 23, showing that the employment situation has slightly improved from a year ago.

About the Survey

The Employment Outlook Survey – conducted in October 2021 – is the most comprehensive, forward-looking employment survey of its kind, used globally as a key economic indicator. The Net Employment Outlook is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting a decrease in hiring activity.

More information available on www.manpowergroup.cz