CZECH EMPLOYERS EXPECT A MODERATION IN THE LABOR MARKET

Prague, 20 September 2022 – For the coming quarter, hiring managers in the Czech Republic are predicting a moderate staffing environment by reporting a Net Employment Outlook (NEO) of 12 percentage points. As in many countries in EMEA, the staffing climate is expected to worsen since the previous quarter. The Czech Republic forecasts the hiring expectations to drop by 7 percentage points since the previous quarter. The hiring environment in the Czech Republic is ranked among the bottom half globally, 18 points below the global average.

Like many countries close to Ukraine, the Czech Republic now sees a dip in hiring expectations compared to last quarter, perhaps as the economic consequences of the Ukraine-Russia conflict begin to drastically influence daily life through staggering inflation and high cost of living. Indeed, Czech employers may be less optimistic than last quarter, as the number of Ukrainian refugees joining the workforce is less than predicted.

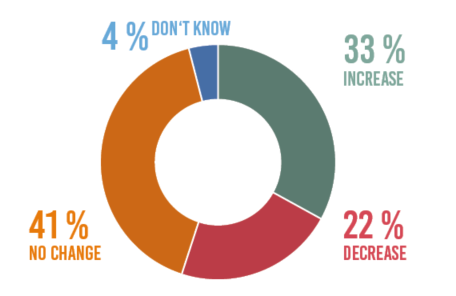

“Optimism in the labour market is declining, but more companies plan to hire than lay off by the end of the year. Compared to the previous quarter, the number of optimistic firms fell from 38% to 33% and the number of pessimistic firms rose from 17% to 22%. The outlook worsened most in large firms with over 250 employees and employers plan to hire the most in the Prague region. On the one hand, some firms are increasing their activity as the problem associated with the covid-19 pandemic fades, while on the other hand we see growing problems, especially in energy-intensive operations,” said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

Industry sector comparisons

Czech workers in 7 of 11 sectors can expect an increase in the hiring pace this quarter, while 2 sectors are expecting a decrease, and hiring decision-makers in 2 sectors expect no change. Since the previous quarter, staffing climates have weakened in 9 of 11 sectors, strengthened in one, and seen no change in one. Since we asked employers this time last year, hiring climates have weakened in 4 of the 7 sectors we have data for and strengthened in 3.

The most competitive sector in the Czech Republic is Wholesale and Retail Trade, with a NEO of 25. Even though expectations in the sector decreased by 3 percentage points since the previous quarter, they rose by 17 percentage points since this time last year. Indeed, Wholesale and Retail Trade is the sector to see the largest increase out of the Czech sectors since this time last year. Employers in the Primary Production sector are less optimistic, as this quarter is the lowest NEO recorded in the Primary Production sector for 7 years, going back to Q1 2015 when it was -6.

Regional comparisons

Employers in all 3 regions in the Czech Republic anticipate an increase in staffing levels in the coming quarter. However, since last quarter, staffing climates have weakened in all 3 regions. Compared to this time last year, hiring environments have strengthened in one of the 3 regions, weakened in one, and seen no change in the last region.

The most competitive region in the Czech Republic is the Prague region, with a NEO of 20. Even though expectations in the region decreased by 4 percentage points since the last quarter, they rose by 3 percentage points since this quarter last year. Prague is also the region with the largest increase since Q4 2021. The region with the largest decrease since this time last year is the Moravia region, with a change of 3 percentage points.

Organization Size Comparisons

Employers in all 4 organization sizes in the Czech Republic anticipate an increase in staffing levels in the next quarter. Since last quarter, staffing climates have weakened in 3 of 4 organization sizes and stayed stable in one. A bit more optimistically, staffing climates have strengthened since last year in 3 of 4 organization sizes but weakened in one.

Czech employers in organizations with 50-249 employees are the most optimistic, with a NEO of 22, remaining steady since the last quarter. Year on year, the expectations in these organizations rose by 11 percentage points. For large organizations with 250+ employees, this quarter is the lowest NEO recorded in 2 years, going back to Q4 2020 when it was 2.

Global Overview

ManpowerGroup surveyed a total of 40,694 employers in 41 countries and territories to measure employer hiring intentions for the fourth quarter of 2022 from October to December. Interviewing was carried out while the effects of the Ukraine-Russia conflict and the COVID 19 pandemic were still prevalent. Furthermore, challenges like rising inflation, high cost of living, and food shortage characterized much of the results this quarter. Therefore, the survey findings for the Q4 2022 period are likely to reflect the ongoing economic disruption in some countries resulting from such challenges.

Based on seasonally adjusted analysis, employers around the world generally expect to increase headcount this upcoming quarter. The Net Employment Outlook (NEO) for Q4 2022 is 30 points. Although this is a slight decrease in hiring intentions since last quarter (-3 points), the expectations are still higher than this time last year (+6 points).

The strongest hiring plans for the next three months are reported in emerging markets like Brazil (56), India (54), and Costa Rica (52), which reflects the strong hiring climate of the South and Central Americas (39) and the Asia Pacific (40). Indeed, the optimism of the developing markets characterized much of the results this quarter, as opportunities for economic growth are generally greater in developing markets than in developed markets. Furthermore, countries like Brazil are benefiting from global challenges such as the food crisis, reporting record-high exports of agriculture products. Similarly, the Indian rupee has strengthened following the country’s success in obtaining cheap energy while the world struggles with soaring energy prices. Therefore, current geopolitical conflicts may signify a growth opportunity for developing markets and thus their workforces.

These regions also see the largest quarter-on-quarter increases in hiring intentions, as Hong Kong and China (+15) report the greatest rise in expectations since the last quarter. China and Hong Kong in particular are bouncing back from the COVID-19 lockdowns prevalent last quarter. However, most countries do not see positive quarter-on-quarter growth. Indeed, Hong Kong and China are among only 16 of 40 countries and territories where the hiring outlook has strengthened since the previous quarter. In a year-on-year comparison, the Outlook strengthens in 23 countries and territories, out of which Costa Rica (+41) and Singapore (+38) saw the biggest increases since last year.

About the Survey

This survey is conducted quarterly to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. The Czech Republic is one of 41 countries and territories participating in the quarterly measurement of employer hiring intentions. The survey for Quarter 4 2022 was conducted by interviewing a representative sample of 510 employers in the Czech Republic and asking the same question: “How do you anticipate total employment at your location to change in the three months to the end of December 2022 as compared to the current quarter?”.

More information available on www.manpowergroup.cz

[/one_half_last]